student loan debt relief tax credit 2020

These adjustments became effective March 13 2020. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings income tax credit for Maryland resident taxpayers that are making eligible undergraduate andor education that is graduate re payments on loans acquired to make an.

Student Loan Debt Crisis In America By The Numbers Educationdata Org

Since its launch in 2017 more than 40600 residents have.

. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Page 3 COMRAD-026 MARYLAD FORM 502SU. This benefit originally included in the Coronavirus Aid Relief and Economic Security CARES Act enacted in March 2020 was for calendar year 2020 only but was extended for an additional five years by the Consolidated Appropriations Act 2021 CAA.

Maryland Student Loan Debt Relief Tax Credit 2020. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were awarded anything. Complete the Student Loan Debt Relief Tax Credit application.

Nvidia 6000 per year and up to 30000 total. Fidelity 2000 per year for up to five years. 31 2020 to Jan.

January 16 2020 by Ed Zollars CPA. Employers can provide up to 5250 annually in tax-free student loan repayment benefits per employee through 2025. See If You Qualify For Loan Forgiveness Under The Public Service Loan Forgiveness Program.

Ad Try Our Free PSLF Tool To See Your Options and Eligibility For Student Loan Forgiveness. To date nearly 41 million in tax credits has been awarded to Maryland residents. The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had.

1 2026 will not count as income. Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. FedLoan Servicing has automatically adjusted accounts so that interest doesnt accrue ie accumulate.

Ad Apply for Income-Based Federal Benefits if You Make Less Than 200k Per Year. File Maryland State Income Taxes for the 2019 year. So where are all the breathless commercials and billboards for relief from academic loans like you see and hear everywhere for credit card.

As part of relief for the COVID-19 pandemic the federal Coronavirus Aid Relief and Economic Security CARES Act passed in March provides significant student loan relief in the form of deferring payments and waiving interest until Sept. The Student Loan Debt Relief Tax Credit is a program created under 10-740. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school. The legislation also allows companies to offer up to 5250 toward an employees student loan payments on a tax-free. Instructions are at the end of this application.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. Tax Relief Expanded for Student Loan Debt Discharge in Certain Cases. Just as the administration provided student loan relief without Congressional approval on March 20 August 8 and December 4 it can do it again.

From July 1 2022 through September 15 2022. Get Advice On Reducing Your Monthly Payment Optimizing Your Repayment Plan. Kronos 500 per year.

Penguin Random House 1200 per year and up to 9000 total. The interest rate on all US. Maryland Student Loan Debt Relief Tax Credit 2020.

The Deadline for the Student Loan Debt Relief Tax Credit is September 15. One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt. First the bill requires the Department of Education ED to automatically discharge ie repay or cancel up to 50000 of outstanding student loan debt for each qualified borrower.

Until the end of 2020 employers can contribute up to 5250 toward an employees student loan balance and the payment will be free from payroll and income tax under a provision in the Coronavirus Aid Relief and Economic. As with other forms of employer-provided educational assistance previously included in the law the amount of the payments is capped at 5250 per year per employee and is excluded from the. You must provide an email address where MHEC.

To qualify for the Student Loan Debt Relief Tax Credit you must. Student Loan Debt Relief Tax Credit for Tax Year 2020. ANNAPOLIS MD Governor Larry Hogan today announced nearly 9 million in tax credits to more than 9000 Maryland residents with student loan debt awarded by the Maryland Higher Education Commission MHEC.

Student Loan Debt Relief Act of 2019. A provision in the March 2021 COVID-19 relief package stipulates that any debt forgiven from Dec. Relief is also extended to any creditor that would otherwise be.

Student Loan Debt Relief Tax Credit Application. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

I didnt receive anything in the mail in December about it like I did last year although everything through USPS is delayed. Department of Education ED-owned student loans serviced by FedLoan Servicing has been temporarily reduced to 0 through August 31 2022. Home Debt Help Advice Debt Relief Help Options Student Debt Relief.

And the relief can indeed be much broader. Aetna 2000year up to 10000 total. Consumers are 500 million deeper in debt with student loans than credit cards.

The Maryland Higher Education Commissionmay request additional documentation supporting your claim for this or subsequent tax years. To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 22. Eligible applicants are Maryland Tax Payers in 2021 who have incurred at least 23.

Here is a list of some of the employers offering student loan assistance benefits. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Excess credits may be carried over for five 5 years.

Incurred at least 20000 in total student loan debt. This bill establishes programs to cancel certain student loan debt and refinance student loans.

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

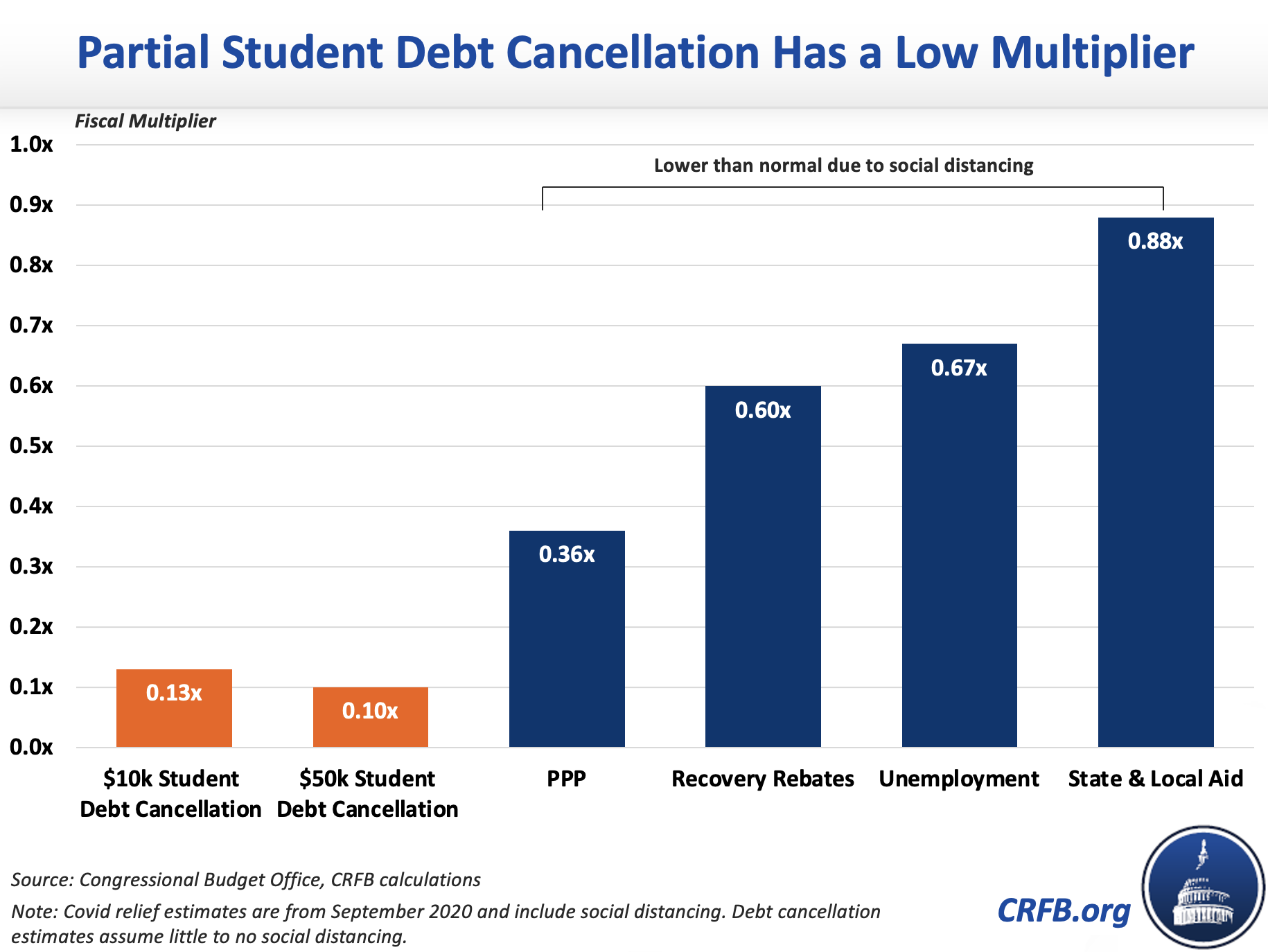

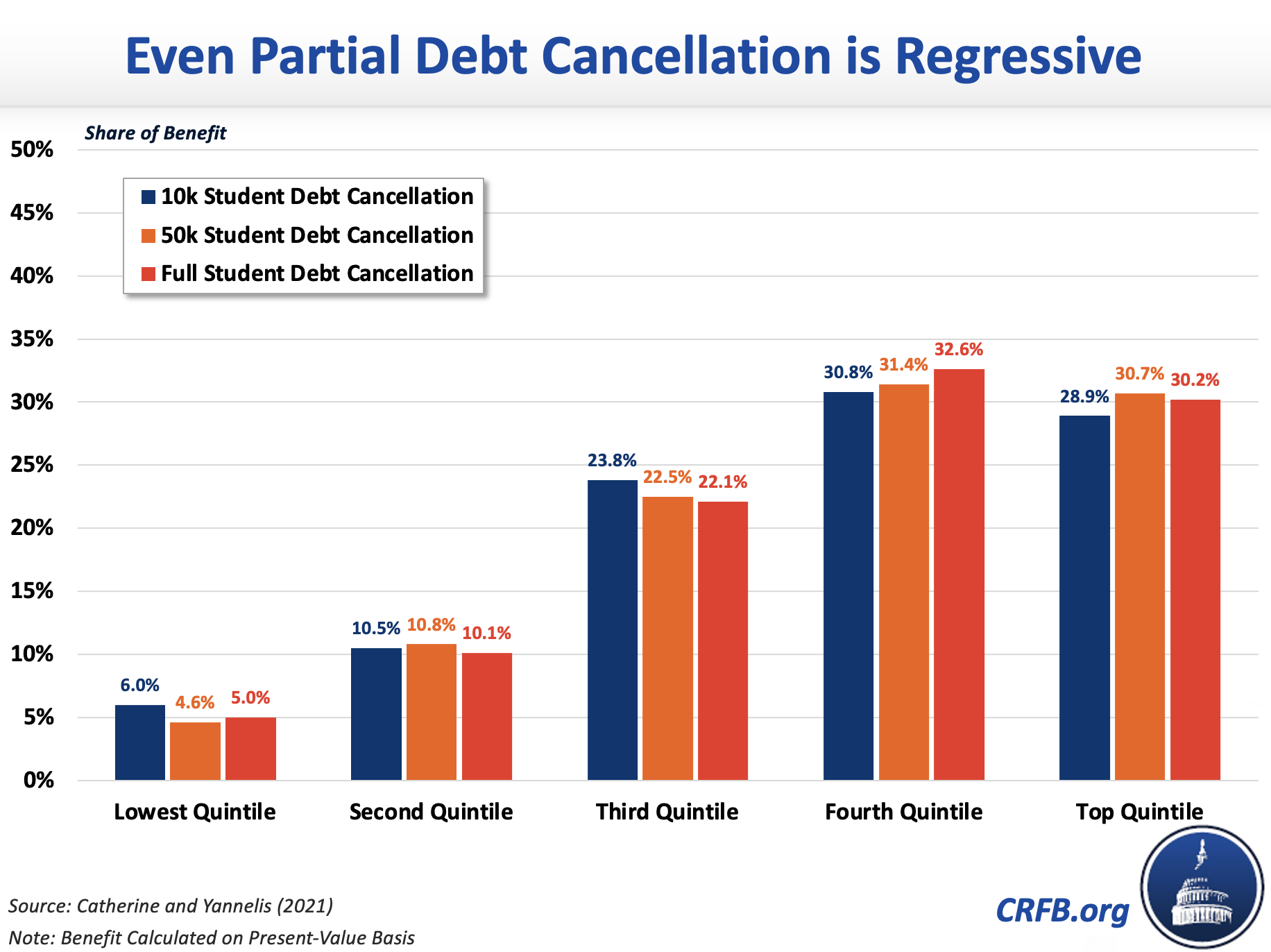

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Coronavirus Student Loan Payment And Debt Relief Options Credit Karma

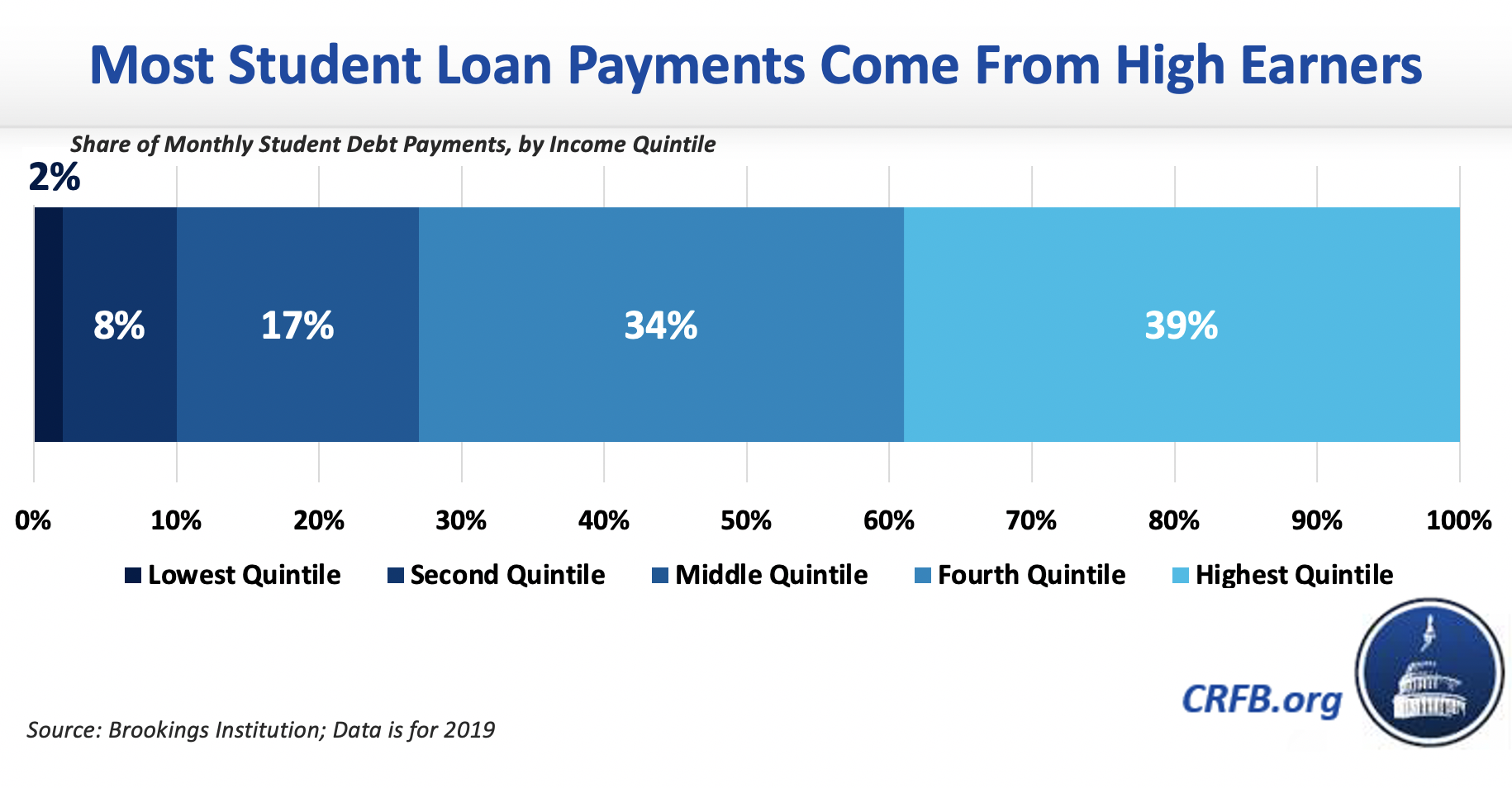

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Student Loan Forgiveness Statistics 2022 Pslf Data

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Is Taking On More Student Debt Bad For Students Econofact

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Who Owes The Most Student Loan Debt

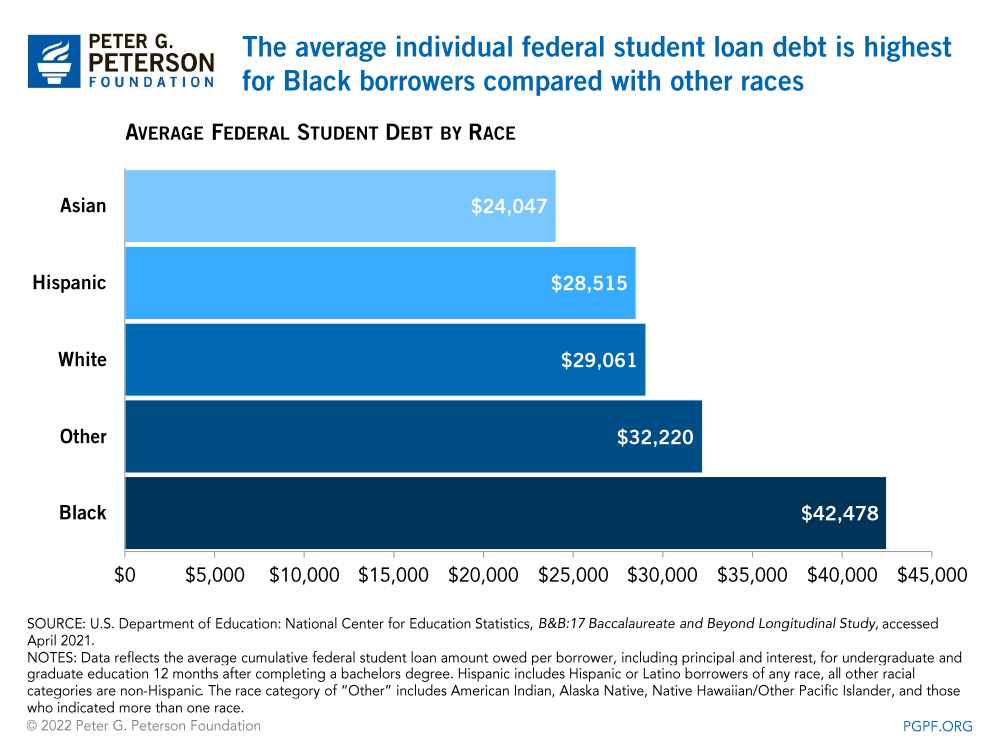

Student Loans The Racial Wealth Divide And Why We Need Full Student Debt Cancellation

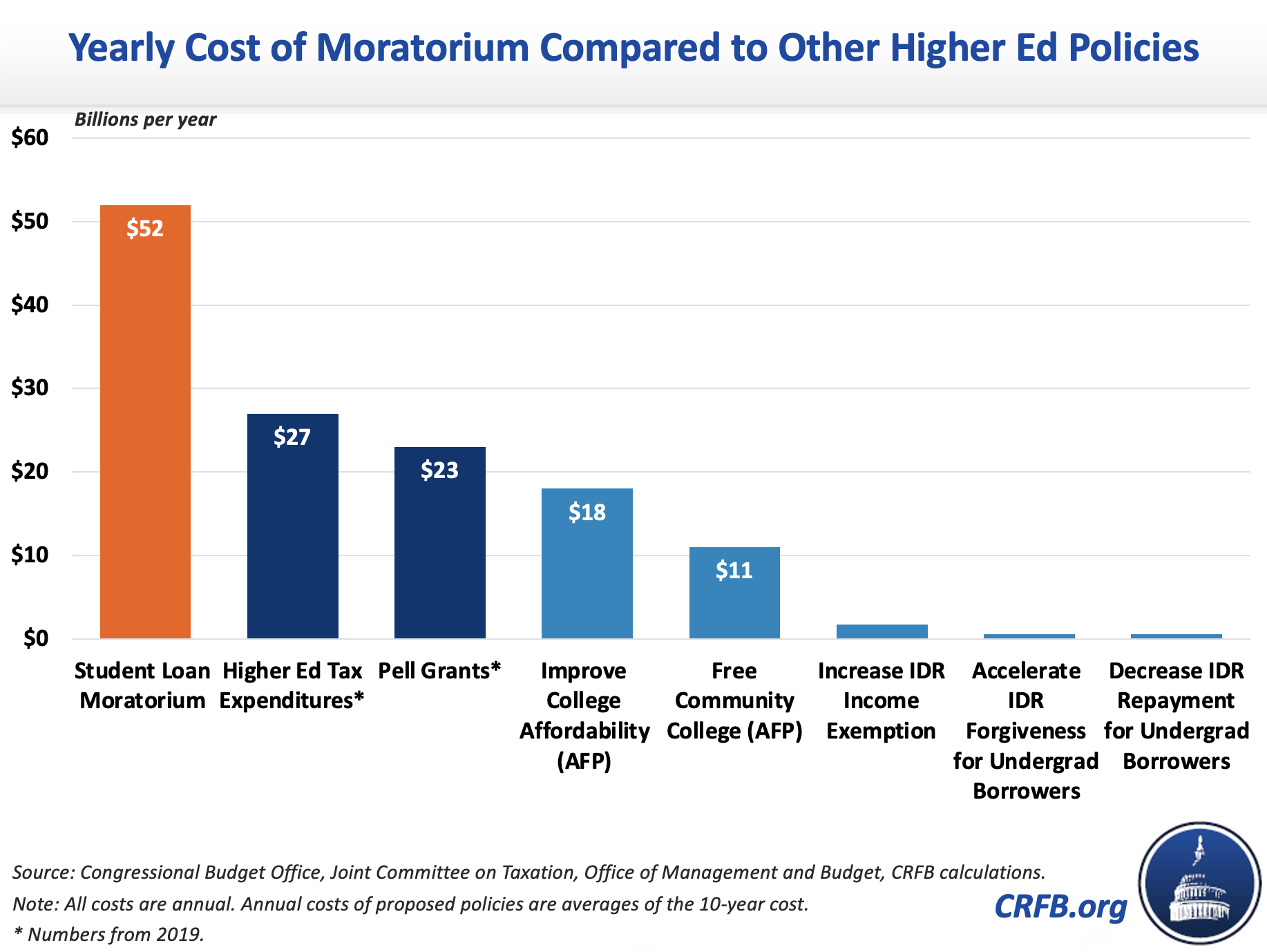

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

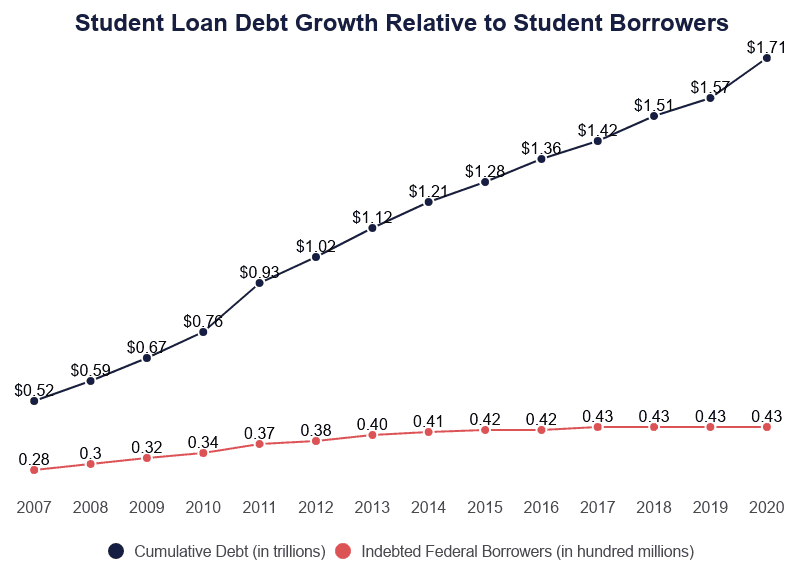

Chart Americans Owe 1 75 Trillion In Student Debt Statista

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero